Kieran’s Our City, Our Town Article,

Cork Independent, 14 December 2023

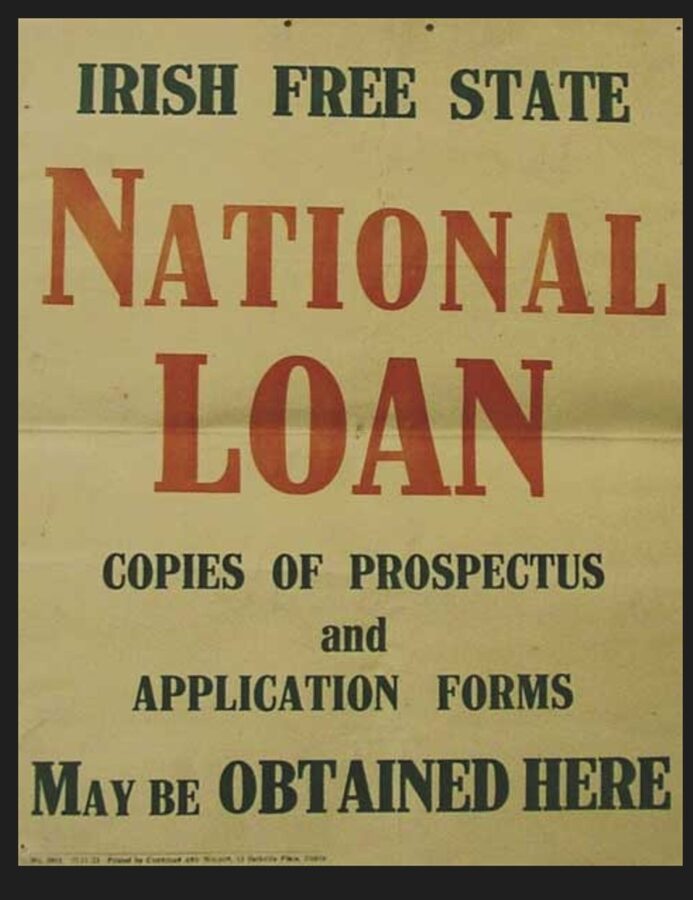

Recasting Cork: The Free State National Loan

In the midst of newspapers such as the Cork Examiner in late November and early December 1923, there are several advertisements on the benefits of subscribing to the Irish Free State National Loan. Based on British War Stock loan methodologies, Irish people were asked to invest their savings in a scheme, which would also give a return on investment.

Westminster reports from one hundred years ago reveal that as a result of the First World War and its costly financial measures, between 1913/14 and 1918/19, government spending escalated more than 12-fold to £2.37bn. Much of this was almost wholly due to military outlays. Over this time, tax revenue did quadruple, but war debt was required to make up the balance. The debt grew from around 25% of GDP to 125% in four short years.

Rooted in the narrative of a sense of duty the Westminster government appealed for support , The attraction to invest was through an offer of an attractive profit on the bonds. Historic reports outline that initially, the government offered 4.1%, well above the 2.5% payable on other government debt at the time. War bonds were loans where principal was to be repaid after ten years. Ensuing war financings would contribute to investors an even higher premium – including the enormous War Loan of 1917 which created £2bn by offering a immense return of 5.4%. Such a yield appealed to individuals, businesses and local authorities.

One of the local authorities was the Corporation of Cork. Indeed, on 1 December 1923, at a meeting of Cork Corporation, the Town Clerk, Mr William Hegarty brought to the Council meeting the question of advisability of transferring the amounts of money that the Corporation had invested in British War Stock into the Irish Free State National Loan, which was open for subscriptions. The Corporation had £37,379 3s 2d invested in five per cent British War Stock and £9,015 13s 0d in four per cent stock British War Stock. If it was the intention of members to transfer such a sum to the National Loan, it could be done at a meeting of the Town Council. William Hegarty noted that such a transfer would yield an increase of £1,870 on the amount of money invested.

William Hegarty also outlined that the Corporation’s British War Loan was to be redeemable in the years 1929 and 1949 respectively. The Corporation had already made £6-£7 per share profit on such an investment. Mr Hegarty also noted that when applying for grants it would also be an advantage of the Corporation to have their money invested in the Free State National Loan project.

Council member Mr J Horgan noted that the Council would be unanimous on the transfer to the National Loan; “When subscriptions were sought for the British War Loan the people of England rushed in with their money to stand by their country when that country was threatened with danger from outside. Now the Irish people had a loan to save their country and themselves and it was the duty of every single individual in the Free State to keep on making that loan a success. It was their duty to do so, and to prove to the world that they had not only confidence in their country but that they were prepared to back that confidence by pounds, shillings and pence”.

Mr Horgan continued that he hoped, and he was sure, that the National Loan would be oversubscribed. He also articulated that the citizens of Cork would be pleased if the Corporation would transfer the money in question to the National Loan and it would be the advantage of the country, the Corporation, and its citizens to take such action. He continued that the business people of the South had already shown their confidence by subscribing liberally to the loan. In the weeks that followed the Corporation made the transfer of funds from their British War Stock to Irish Free State National Loan.

Mr Horgan’s general sentiment of public support had also been expressed at a meeting of the Cork Progressive Association two days earlier on 28 November 1923. JJ Walsh TD and Postmaster remarked that there had been an excellent response to the National Loan; “This applied not only to people of property, such as the farming and shopkeeper community, whose business must necessarily receive a stimulus because of the greater circulation of money in those elements of the population, upon which they depend for a market, but also, and still more important the fact the honest unemployed man will at last get an opportunity of earning the wherewithal to support himself and his family”.

The public as well as small and big enterprises also took an interest in the National Loan. For example, the Cork Examiner lists a sum of £20,000 from Messrs Dwyer and Co, on behalf of themselves and their employees, was subscribed to the National Loan.

Initially a national loan of £10 million was successfully floated in Dublin. The loan was over-subscribed by £200,000 giving a vote of confidence to the Government and its financial management.

Kieran’s new book The A-Z of Curious County Cork is available in good Cork bookshop.

Caption:

1232a. Pamphlet for Irish Free State National Loan, Winter 1923 (picture: National Library, Dublin).